RAFAŁ BILL

I will ask simple question: which economy is the largest? Everyone interested in such topic would answer: American. Correct. Then I ask next question: which economy is second? You probably answer China. Wrong. It`s shadow economy.

What is shadow economy? Definition is simple – it`s grey and black market. It`s all economic activity outside legal structure of state. Size of shadow economy in the world is estimated at 10 trillion dollars. USA has got a GDP of 14 trillion. In 50 countries around the world shadow economy is 40% the size of documented GDP. Inglorious champion is Georgia – trade and goods off the books elevated over 70% of its official economy. Steven Levitt and Stephen Dubner, known for their Freakonomics, discussed how shadow economy grows bigger and bigger.

In 2009, the OECD concluded that half the world’s workers (almost 1.8 billion people) were employed in the shadow economy. By 2020, the OECD predicts the shadow economy will employ two-thirds of the world’s workers. This new economy even has a name: ‘System D’.

The name ‘System D’ was used in French slang in Africa and the Caribbean. Its origin was explained by Robert Neuwirth who`s founder of blog squattercity and researcher on shadow economy. The ‘D’ is taken from the French word ‘debrouillard’ and ‘D man’ means resourceful and ingenious person. It states doing business without paying taxes or at least attention to public administration. It needs to be underlined: this kind of person, working in ‘System D’, is marked positive in society, it`s acceptable and even sometimes recommended to avoid legal state.

Graph 1. Shadow economies as % of GDP in chosen states 2006-2010 Source: The Economist

Source: The Economist

As we can see, after a decline in 2008 shadow economy as percent of GDP is on rise again. Probable clue to interpret this new trend is present economic crisis. Shadow economy is a way to avoid tax burden and save profits in tough times. This kind of behavior was perfectly explained by Laffer curve.

Graph 2. Laffer curve

Source:Wikipedia

It presents simple correlation – if government puts on higher taxes, at some level taxable income will decline due to the fact that high tax burden affects people revenue and they start to save their money illegally from greed country. It`s exactly what happened in last years and still carries on.

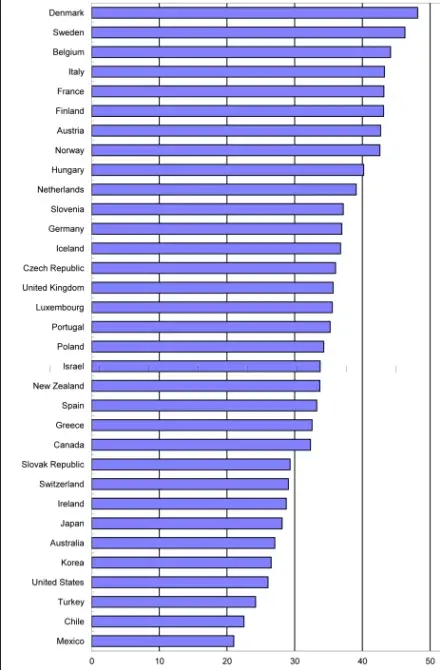

Graph 3. Tax burden in chosen states Source: Inflationdata.com

Source: Inflationdata.com

Tax burden in most developed states reaches even 50%. It means that half money of citizen is taken by government for public expenditures. It could suggest that shadow economy would be large in such countries. Actually, it`s only partly true. Nordic countries which have got high taxes are states with small-scaled shadow economy. On the other hand, southern members of European Union like Italy and Greece are champions. Other ‘winners’ are situated in Central Europe. You can only guess that it`s matter of law culture, development of society, effectiveness of state and many more factors.

Nobel Prize-winning economist Milton Friedman once commented:

‘The black market was a way of getting around government controls. It was a way of enabling the free market to work. It was a way of opening up, enabling people.

Machinery of state stops working. First sign of its failure are most frequent crises. Second signal is a rise of shadow economy. There are only two ways out of this negative situation. First, governments may try to increase taxes, control, economic stimulus to inject new energy in economy. However, it`s not working like an engine – you cannot just put some fuel in and make it start to work automatically. Economy is created by live people. Second solution is much more simple. It`s implementing free market. It means really FREE market without restrictions and wide control by state. In such terms economy will be able to recover to natural balance trusting general law of demand and supply. Simultaneously shadow economy will decline step by step as more money would be held by people themselves and they wouldn`t need to avoid legal structures.

Shadow or not, China still has second largest GBP;)

*GDP